‘Innovations for Crisis’ and Financial Meltdown: Implications for Growth and Economic Policy[Paper was later presented in “Confluence 2008”, Seminar Series conducted by Sree Narayana College, Alathur, Palakkadu affiliated to Calicut University, on 18th of November, 2008.]

1.1 Introduction

The much famed “Wall Street” simply became ‘Fall Street’ on an otherwise sunny day sending panic signals across the globe. The integration of markets of different countries, especially financial and capital, as a consequence of the so called resounding success 0f globalisation made its impact felt so swift across borders! This time it did not let the ‘mature economies’ go scot free who often proudly pontificate the virtues of ‘transparency’ and the benefits of religiously adhering to the capital adequacy norms of Bassle Settlements to the hapless chaps who struggle in the southern part of the equator . At last, globalisation showed its true colours and once again unfettered capitalism proclaimed from the roof top that it is so brittle and so irrational.

1.2 Excess liquidity growth and the eventual fall down

It is better to understand the chain of events that may happen when the central bank injects liquidity (or increases money supply) into the system. Increased liquidity means increased purchasing power and what usually follows is that, it moves to those areas where it can take more returns. Borrowing becomes the rule as rate of interest falls and the funds thus taken, will be parked at lucrative avenues. Naturally, financial assets like shares, securities etc and real estate becomes the preferred avenues for investment. Their prices then start to climb and a boom like situation sets in the economy. The upward movement of the economy gradually raise the concerns of inflation as prices are moving up. As inflation rises, the real rate of interest beings to fall (real rate of interest = nominal rate – inflation). To counter act, central bank intervenes in the market and take measures to raise the rate of interest to put the inflation under the leash. When interest rates rise, the prices of assets like shares and real estate becomes over valued and a switch back will happen from shares, real estate, etc to bank deposits and related form of assets. As such, prices of shares or real estate begin to fall and eventually the economy crash-lands and crisis unfolds the pall of gloom.

1.2.1 Three instances of Excess Liquidity in 20th Century

The three notable instances with excess liquidity growth in USA happened in 1928, 1987 and 1999. The last one was the result of dotcom and tech bubble during which the liquidity growth was at an annualized rate of 76% in the last quarter of 1999. At that time the Fed was preparing to deal with the ‘Y2K situation’ and wanted to make sure there was enough liquidity in the system. As a consequence, stock prices took a steep upward movement and the Nasdaq Composite stock index rose 107% in less than 6 months only to decline by -50% later.

1.2.2 Aftermath of dotcom bubble and 9/11, 2001

The investment in US fell remarkably in the wake of shattered business confidence after the dotcom bubble and lingering uncertainty consequent of the terror attack of 9/11, 2001. The US Fed adopted the easy money policy to restore confidence and to prop up rate of investment. Rate of interest started to fall and stayed below 2% level through out 2002-2005. Since September 11, 2001, a new mantra of ‘borrow and spend’ was coined where “consumerism has been cast as new patriotism”. The cheap money policy of the US Fed at last helped the economy to take a U-turn and a new growth trajectory was made visible by 2002. 1.2.3 Sub-Prime lending It was proclaimed as loudly as possible that the new growth trajectory, after the dotcom bubble, was the telling outcome of the resilience of the capitalist system which is so efficient, innovative and powerful to lay out new paths when the human ingenuity is let free to take course. As pointed out above, the continuous injection of liquidity into the system helped the rate of interest to fall considerably and to stay below 2% up to the end of 2005. Borrowing became easy and an effortless thing and the funds were recklessly spent on conspicuous consumption and investment in stocks and real estate assets. Spending on new residential houses became the preferred item. As demand for housing increased real estate prices also took an upward movement.

This booming price of housing and real estate assets gave a golden opportunity to the ‘innovative scamsters’ and speculators of the so-called ingenious financial markets. For private lenders, credit worthiness is one among the important criteria for giving loans. Credit worthiness is quantified through computing credit scores. Credit scores help to know about the payment history of the borrower. The score quantifies the credit history in terms of his ability and willingness to repay the loan taken by the borrower. This is done often by assigning a numerical value. A credit score greater than 660 makes him a prime borrower. Borrower with a score less than this is called as a sub-prime borrower and will not normally get loans because it is risky to lend. Their credit worthiness is considered as poor. But they also get loans if the additional risk is covered through higher rate of interest. Lending in this manner is called as sub-prime lending. Sub-prime lending involves sub-prime mortgages, sub-prime credit cards etc.

The main risk in the normal bank lending process is called as the ‘credit risk’ or the risk of default. Since the sub-prime lenders have high risk regarding default, they are offered loans with higher rate of interest than that of given to prime customers. Since the Fed rate is well below 2% level, even a higher rate of interest appears lower to such sub-prime customers.

1.3 The role of ‘Innovative’ derivatives

To reap the full benefit out of the boom situation, the financial institutions want to increase business as far as possible through whatever means possible. The original lenders who directly lend to the house owners for making the real estate purchases have a resource limitation in extending the business after a point. In this context, the financial derivative

[1] ‘Mortgage Backed Securities’ (MBS) comes into the scene.

MBS is an asset backed security (ABS). Assets can be anything that has cash flows like mortgage loans, home equity loans

[2], credit card payments, auto loans, etc. When the underlying assets are home mortgages it becomes MBS.

MBS is a repackaged loan. After the purchase of housing loans from banks and other non-banks which originally gave the loans , the financial institutions repackage them by pooling several loans into one. In other words, the housing mortgages are bundled together to form a single asset. By taking the original housing mortgage as the core asset they issue the financial security called as MBS. The MBS gets value only because it is backed by a real asset. Thus the value of the MBS depends upon the value of the basic/core variable or asset.

Then MBSs will be sold in the secondary capital market. This issue of new security (MBS) out of the original mortgage loan is called as the ‘Securitisation’ of residential mortgages

[3]. The proceeds they earn from the sale of MBS will then be used to purchase new set of original mortgage loans from the primary lenders. In that process primary lenders are provided with liquidity enabling them to give fresh housing loans.

1.3.1 The Business Operation

As pointed out above, the original providers of housing loans are banks and non-bank mortgage institutions. Their capacity to make loans is limited by the availability of their resources. But the US government wanted to raise that limitation and liquidity in mortgage financing. Thus Fannie Mae

[4] and Freddie Mac come into the picture. Up to 1968 only Fannie Mae was there and it purchased and held these housing loans with it from the originators of the loan. Fannie Mae raised resources from market by issuing debt in the form of securities. The interest rate on the securities issued by Fannie Mae was lower than the rate of interest charged for housing loans. Thus the spread between the rates is the income of Fannie Mae. Once Fannie Mae purchases loans from originators, they will get fresh resources which could be in turn used for giving new housing loans. Only that loans which are following the guidelines of Fannie Mae alone were purchased. Such loans are called as conforming loans. By and large this was the system up to 1970. Since these loans are conforming to the guidelines of Fannie Mae they were safe for the purchase and so posed no threat.

After 1970 with the creation of Freddie Mac, the new instrument MBS (Mortgage Backed Securities) were issued first in 1971. Fannie Mae also followed suit by 1981. Earlier they were only purchasing the loans by issuing debt. Now they were responding to the ‘innovations’ of financial market by issuing MBS.

MBS securities were purchased by the ‘Investment Banks’ in the Wall Street or else where. A guarantee will be given that the principal and the interest payments are given to the investment banks irrespective of any default by the original borrower. The institutions which issue MBS also benefits by collecting guarantee fee, service charge etc from the investment banks. It will also receive an interest rate spread. For example, if the rate of interest of the original loan is 6.5%, MBS institutions can take up to 2.5% as their various charges and only the remaining 4% rate of interest paid by the original borrower will be handed over to the investment banks. Thus it was a win-win situation for all players according to market enthusiasts. Even a 4% interest payment was a bonanza for the investment banks who were sitting on huge cash balances received from super rich persons. As long as these original mortgage loans were given to prime borrowers there is no apparent threat. Further more, MBSs were issued by government sponsored enterprises like Fannie Mae and Freddie Mac and there is only minimal risk. This was the situation up to 1995 or so.

But the landscape changed dramatically during the 1990s. It all started innocuously as private financial institutions sensed an opportunity in extending loans to self-employed individuals. The nature of their employment and the variable behaviour of their income and the consequent problems in furnishing documentary proof thereof initially motivated them to relax the requirements for becoming eligible for loan. Self certification of income, employment nature etc were became the only requirements. The additional risk in granting such loans is compensated by charging higher rate of interest. Later, loans are issued with still reduced documentation or with no documentation! The additional risk in such lending is covered by adopting the ‘risk-based pricing’ policy, that is, by charging higher rate of interest. (Such loan offering is prevalent in India also especially in the two wheeler loan market by following suit but surfaced only 2003 or so.) Gradually this way of dispensing loans were aggressively attempted by private entities to borrowers who have low credit scores. The additional risk is compensated by charging higher rate of interest.

But with high interest rates there will be only few takers for the loans. The borrower is attracted by offering low initial interest rates which will gradually but progressively increase after a small period. Such loans are called as adjustable-rate mortgages (ARM) where the rates for the initial 2 years were fixed and after that rates become flexible and is calculated by indexing them with LIBOR (London inter bank offered rate) plus a margin. During the initial period teasing interest rates (ranging from 0—2% interest) are offered. Both the borrower and the lender forget about the difficulty in repayment of such high interest loans by persons having poor credit worthiness. They simply gamble on the increasing real estate prices and put their hopes on it. The lender promises that a refinance option will be given at favourable terms and rates as and when there happens sufficient increase in residential prices. Everything appears fine as long as the real estate prices are booming.

1.4 The Complicated Phase of Sub-Prime Lending

Lending to self-employed with relaxed documentation requirements is understandable given the nature of their employment and income behaviour. But as time elapsed funds are loaned even as both the lender and the borrower knew each other that false statements are furnished in the self attestations. No body cared it and increasingly indulged in activity called as sub-prime lending. Even government sponsored agencies like Freddie Mac started to issue MBS with sub-prime mortgages as early as 1995.

The sub-prime lending and the MBSs of agency issuers like Fannie Mae and Freddie Mac were backed by their guarantee against any default. But this is not the case with non-agency MBSs (issued by private banks, investment banks, insurance companies, pension funds etc). No guarantee is there for the sub-prime element under such MBSs. The added credit and default risk were not covered. Even in the case of agency MBSs, the added risk created problems.

As a consequence, financial derivative called as CDO (Collateral Debt Obligations) surfaced in the sphere. Another credit derivative CDS (Credit Default Swap) also came into the scene as a cover of insurance in the event of any default.

1.4.1 Collateral Debt Obligations (CDO)

CDO is a special purpose vehicle. Assets form the core of a CDO. Assets of a CDO can be anything ranging from mortgage backed securities, corporate loans, bonds etc. The structure and assets of a CDO can vary on the basis of the structure and assets it holds. But the essential mechanism of all CDOs is same. CDOs offer access to various financial instruments issued by different entities through a single instrument. Hence the purchaser of CDO can have a diversified portfolio of assets and is believed to have helped him to diversify the risk.

Since CDO has a divergent portfolio, the risk associated with it also has a hybrid nature. Apart from that, the cash flow for the underlying assets is also not uniform and may have different repayment periods etc. When assets of a CDO are segregated on the basis of nature and degree of risk, and returns different layers or tranches are created. Some assets like MBS with prime borrowers have low risk while MBS with sub-prime borrowers have high risk. When they are segregated, the CDO is said to have two tranches

[5]. Generally CDOs have three tranches called as Senior (lowest risk an AAA rated), mezzanine (medium risk) and equity (high risk and unrated). Investment banks purchase tranches according to their appetite for risk and this segregation of assets on the basis of risk is supposed to have helped to price securities in a more efficient manner.

CDO became essential as sub-prime lending was aggressively attempted in massive volumes which made it more and more risky as more and more poorly credit rated individuals were given loans . CDO deals with such increased level of risk. Already sub-prime MBSs are very risky. As new and new individuals with still poor credit scores are made eligible for loans it became very risky to buy such MBSs. The introduction of CDO thus enhanced and ensured continuous market for MBSs. The different layers or tranches are so created that it will be credit rated impressively by ‘independent credit rating’ firms. But it is now revealed that these very ‘independent’ credit rating firms colluded with the issuers that it advised how to design a CDO layer and to earn triple ‘A’ rating!

Apart from that, initially CDO were sold with ‘Credit Enhancements’. Its purpose is to reduce the risk associated with CDO. It reduces the risk by adding other assets (or collaterals like property, inventories, oil reserves, etc), third party loan guarantees, credit insurances etc with the CDO. All this give an assurance to the purchaser of CDO that it will be compensated if the original borrower defaults in any event. But as time elapsed, the level of credit enhancements were reduced and even not resorted at all.

CDS (Credit Default Swap) is another instrument which gives insurance to a bad or doubtful debts or CDOs. The investment bank which bought sub-prime CDOs was concerned about the associated risks. They purchase CDS from insurance firms or other financial institutions. In the event of a credit default the seller will make the payment and in that way CDS provided insurance cover for sub-prime doubtful CDOs. Insurance firms which sell CDSs, in turn, charge a protection fee similar to insurance premium. Thus the institutions thought that the risks involved with CDOs are effectively insured and neutralised! The ‘super efficient’ financial institutions took complete solace (with CDOs and CDSs) in the process of sub-prime fuelled economic boom

[6]. Apart from normal CDOs , CDO squared and CDO cubed also surfaced. The CDO squared is created in the same manner in which CDOs are created but the underlying assets is CDO itself and the asset base of the CDO cubed is nothing but CDO squared!

In manner explained above, the ‘innovative’ financial institutions created lot of derivatives again upon the CDOs and sold them to all sorts of financial institution across global capital markets including investment banks, hedge funds, pension funds, banks, non banking financial institutions, insurance companies etc who were replete with resources collected from super rich individuals, pension and insurance contributions of ordinary citizens. The pricing of such additional financial derivatives were computed by using sophisticated computer models regarding the behaviour of the original borrower and the various possibilities like prepayment, curtailing, foreclosure, part payment etc with ever revising assumptions regarding the behaviour! Any way, the level of sophistication in the computer modelling notwithstanding, once a crisis happens at one spot, it spills over and all institutions, which indulged in this crazy and greedy rush for registering profits, across the globe, would fall like nine pins.

1.5 The Onset of the Crisis and the Downfall

When the interest rates started to move northwards by 2006-07, it became very difficult to repay the sub-prime loans. Moreover the adjustable-rate mortgages (ARM) entered into the phase of flexible rate regime when interest rates increased. The borrowers felt it difficult to make the repayment in these situations. The result was increased default rates and foreclosure rates. By that time housing prices also started to fall consequent of the fall in the demand for housing with the rise in rate of interest. When financial institutions attempted to sell the defaulted mortgages to recoup their money, they found that their value has been fallen well below the amount of debt on it! Crisis loomed everywhere and the rest of the story of collapse became history.

1.6 The lessons from the whole episode

Private lenders normally do not extend credit to customers having poor creditworthiness. Credit worthiness includes the repayment capacity, payment history, defaults committed for previous loans etc by the loanee. But these private financial institutions want to show a bloated balance sheet with bulging profits continuously and this greed prompted them to somehow give loans to even customers having poor credentials. A boom like situation in real estate sector gave them a golden opportunity. Even if a default happens, the value of the underlying asset (the house upon which loan is given) is high enough to pay the principal and interest as far as the real estate prices are soaring. They could sell the mortgage through ‘foreclosure’ and recoup what ever amount involved it in the form of principal, interest payments, other related charges etc. So these hell-bent lenders of all sorts, made all these lending bonanza and wrote all sorts of financial derivates upon them, with the clear understanding about the risks involved. They were very sure that they could sell all the mortgages in a soaring real estate market for hefty profits in any event of default.

The other financial institutions who are not directly involved in the sub-prime fuelled boom process like European and Asian banks and financial institutions (including the UK arm of ICICI bank and State Bank of India etc) purchased different kinds of derivatives created from the original housing loan given in US with a view to registering quick and easy profits.

All this clearly underscores the simple fact that in an era glorified phase of globalisation and unfettered capitalism all players wanted to show ‘growth’ figures in the monthly/quarterly/annual reports. Growth was so glorified, irrespective of the area in which it happens, and an artificial aura has been deliberately painted around it. The more substantive ‘growth process’ was relegated to the back place in the run-up towards the present crisis.

It is argued that the securitisation process and with the use of the so-called innovative derivatives, the risk associated with debts were successfully diffused. Robert Kuttner, who was once Business Week columnist, however, pointed out that securitisation of mortgages resulted in the concentration of risk rather than diffusing it, as every one is placing hopes on the soaring prices of residential plots. And exactly this was what happened.

1.6.1 Growth Concerns and Independent Policy making

It is now officially announced that Germany and Japan have entered into a phase of recession. The growth predictions of RBI have also taken a tail spin. In a glorified era of globalisation where the integration of global financial markets plays a vital role no country can keep away from a crisis that happens in few markets. Indian financial institutions had only a low exposure to sub-prime crisis as majority are public sector enterprises. But the largest private financial institution, ICICI bank, has indeed exposure to this crisis but it is the domestic regulatory environment prevented such institutions to indulge neck deep in to shady financial transactions like this. It is worth noting the fact that it is not because of any prudence or transparency in the dealings of the management of private institutions that averted a full fledged crisis in India but the strong regulatory environment and the irresistible resistance from the public that really saved the economy form the hell-bent reformers of Indian establishment.

But the opening up of capital market and the consequent inflow of funds from Foreign Institutional Investors (FII) that simply bloated the foreign exchange reserves of RBI is creating great problems to the economy. FIIs are taken back their investments by selling the shares and this was the reason for the heavy outflow of dollar in the past few weeks. The consequent fall in liquidity, as rupee is handed over to RBI for dollar by FIIs, is creating problems to the economy. It is to deal with this liquidity crunch RBI announced a slew of measures including reduction in CRR, repo rates, increased rate of interest for NRI deposits etc. SEBI has given permission to issue Participatory Notes (P-notes or PN) by FII to check the outflow of foreign exchange.

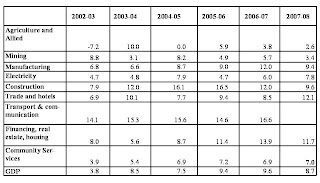

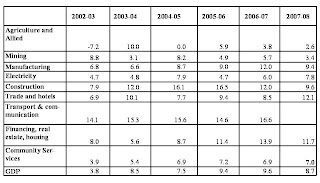

Rupee depreciated from around 39 to 49 between the period of January to October 2008 vis-à-vis US dollar. The SENSEX also took a dovetail from around 20,000 to around 10,000 during the same period. RBI intervened in the market heavily otherwise the exchange rate would have plummeted something near to Rs 60 per dollar! But even the Rs 10 depreciation could not help to boot exports in a situation of global recession. Export sector is already crippled with the crisis. The following table gives the sectoral growth rates of Indian economy. The share of agriculture is near to 20% while the service sector accounts more than 50% and the industrial sector accounts more than 25% of the GDP. Rate of growth of GDP at factor cost at 1999-2000 prices (per cent)

Rate of growth of GDP at factor cost at 1999-2000 prices (per cent)

Note: Plan period is simple average.Source: Economic Survey, 2008

The growth rate of service sector will be more affected consequent of this crisis. Since the sector’s share in GDP is higher its impact will also be greater on the overall growth of the economy. The Indian case becomes a lucid example as to explain how speculation in an open capital market led by FIIs creates havoc in the entire economy.

Independent policy making that takes into account the domestic realities and development objectives were the causalities during the heyday of neo-liberal economic policies shamelessly implemented by the market messiahs from 1991 onwards. One specific incident is pointed out to underscore the argument. The enactment of ‘The Fiscal Responsibility and Budget Management (FRBM) Act 2003’ that came into effect on July 5 2004 was taken by following the footsteps of neo-liberal paradigm and the policy initiates taken by nations like US. The eventual objective of the FRBM Act is highly susceptible given the words of the all-influential Milton Friedman, the champion economist of free market economy who clearly articulated that “A balanced budget amendment . . . is a means to an end. The end is holding down the growth of (or better sharply reducing) government spending” (Wall Street Journal, 4 January 1995, p. 12).

It is the Eleventh Finance Commission that set the ball to roll. It recommended the contents of the monitorable fiscal reform programme and the role envisaged for the next finance commission in reviewing the monitoring and implementation of the grants given under Article 275 of the Constitution. Prof. Amaresh Bagchi, member of the Eleventh Finance Commission, has given a note of dissent that the commission is not competent to make grants given under Article 275 of the Constitution conditional on implementation of a monitorable programme. But his views were brushed aside by taking shelter in the normative concept of sound finance in the Article 280 (3d) of the Constitution . It is through this backdoor the centre government forced the state governments to enact FRBM acts with a clear view to cut down public expenditure.

In addition, it must be noted that the decision to allow a small part of pension to be deposited in capital market is a grand strategy to make valid arguments beforehand when again in future the government need to save the capital market from similar crises.

Now the same perpetrators of this neo-liberal policy is advocating for a fiscal stimulus to the economy! The Economic Times, enthusiastic supporter of market reforms wrote an editorial titled ‘Fiscal stimulus needed’ on 17th of November, 2008! ‘The Teleraph’ published from Kolkatta, which has no left leanings, wrote on 14th of November, 2008 that Manmohan Singh was burdened with the contradiction of rejecting the left arguments for government interventions but to advice the same to global leaders to move out from this crisis!

What is relevant in the present context is how the government is preparing to design the fiscal stimulus for the economy. India has its own peculiarities and development objectives that need to be taken into account. More important is the fact that ‘fiscal stimulus’ is not a policy tool that has potency only in a phase of economic cycle. This aspect should be taken in to account before designing the details of the rescue plan.

1.7 Recapitulation

The present crisis demolished all the arguments that were repeatedly proclaimed from the roof-tops that ‘the government that governs least is the government that governs best’. All such arguments are laid to rest with this crisis. Media is abound with reports that the finance minister is busy advising public sector banks to lower interest rates contrary to the market philosophy stance that ‘market will correct by itself’. If are markets are let to correct itself there will be not only recession but would happen an all-round crisis as well. This is the most important lesson to be learnt from this crisis.

The crisis revealed that the so called ‘innovations of the financial market’ are nothing but machinations to amass profit at cost of public. It must be discerned that this greed for profit cannot be curtailed down by simply constituting regulatory mechanisms and other controls. It must be realised that capitalist system will devise ingenious methods to bypass whatever regulations imposed upon them in their quest to amass profits. The capitalist system could not function with out ever increasing profits lest it would not become capitalist system. The rescue plan must contain elements that reflect this inherent nature of forces of capitalism that drives the capitalist economy.

Visit at: www.santhoshtv.in

Endnotes

[1] Derivatives are financial instruments whose value depends upon the values of the underlying basic variables or assets. Options, futures are the popular examples of derivatives.

[2] Home equity loan is a loan given to an existing home loan borrower by considering the market value of the property for purposes like home improvement etc.

[3] Securitisation is a process whereby a financial asset is transferred into a security by pooling and repackaging the financial assets having cash flows in the form of interest and principal payments.

[4] It is instructive to have a brief idea regarding the institutions that roam in the terrain of residential mortgage markets. Both GSEs (Government Sponsored Enterprises) and private players are operating in the field.

One of the re-construction efforts initiated by Franklin Roosevelt through the ‘New Deal’ after the Great Depression of 1929 was in the field of housing. The ‘Deal’ wanted to stimulate house construction and tried ways to provide adequate credit for it. It wanted to establish an active and efficient secondary mortgage market. Thus it formed the “Federal National Mortgage Association (FNMA). It is commonly referred by the market participants as ‘Fannie Mae’. It was originally created as a federal agency under the ‘National Housing Act’ of 1938. But in 1968, it was split by an amendment to the ‘National Housing Act’ and converted ‘Fannie Mae’ into a GSE (Government Sponsored Enterprise) but to be run as a private corporation with a view to removing its activity from the federal budget to deal with the federal budget deficits . As a result ‘Fannie Mae’ could not be a guarantor of government-issued mortgages, which it was prior to that. That responsibility was then given to a newly created entity popularly called as ‘Ginnie Mae’ or the “Government National Mortgage Association” (GNMA).

Later with the passage of The Emergency Home Finance Act of 1970 another mortgagee entity called as ‘Freddie Mac’ (Federal Home Loan Mortgage Corporation) was also created. Its objective was to create a national level secondary market for residential mortgages and to increase the level of competition in the mortgage market.

[5] Suppose the bundled portfolio has a yield of 12% but different assets have varying risk. The first tranche having prime MBS are offered with an 8% return and the second tranche having sub-prime MBS is offered with a 16% return because of the higher risk it bears. Note that the weighted average of yield is equal to the yield of the initial portfolio.

[6] It is the CDS that was the main reason for the collapse of the insurance giant AIG. CDS were of the tune of 45 trillion US dollars (1 trillion = 1000 billion) on mid of 2007 which is almost double the market capitalisation of US stock market which had a value of only 22-25 trillion US dollars!