Monday, November 3, 2008

As a consequence of the transfiguration and transmission of US financial crisis into a full blown economic crisis across the globe, the Indian foreign exchange market also nosedived into new abyss. The exchange rate plummeted from Rs 39 per US dollar on the beginning of January 2008 to Rs 49 by early October 2008. The Sensex also dovetailed from 20,000 to 10,000 during same period which accentuated the role of volatile movements in the capital market upon exchange rates. Dissecting further, FII or the hot money component in the Indian capital market was quite high during this period and FIIs took away $11.1 billion during the first nine-and-a-half months of calendar year 2008, of which $8.3 billion occurred over the first six-and-a-half months of financial year 2008-09 (April 1 to October 16). It is this highly volatile hot money component that rendered Indian capital market so capricious which eventually pulled down the exchange rate to the new abyss of Rs.49-50 per US dollar.

When FIIs all around the globe pumped money into the capital market The Indian government rolled out red carpet welcome to these forces of market fundamentalism. They all showered praises for the Globalisation and liberalisation policies of the government and then and there pointed out that it was because of the strong Macro economic fundamentals of the nation. But when exchange rate appreciated as the supply of foreign exchange increased due to this FII inflow, the government and market fundamentalists did not let things to the so called omnipotent market mechanism (forces of market demand and supply). Instead, they intervened in the market, a position that these market fundamentalists loathe when interventions are made for improving the life of people, and purchased all the foreign exchange brought by the FIIs through various measures. The consequence was that when RBI purchased the foreign exchange it resulted in pumping liquidity into the system. All private players and the pro-market government were so delighted in that economic situation.

US Financial Crisis, Capital Market and its consequences

But things changed dramatically consequent of US financial crisis. FIIs took away all their money and as a sequel, Sensex and exchange rate dovetailed to find all new low lying areas. Exactly the opposite of the events followed and liquidity was squeezed out. The economy witnessed the clamour from all quarters and from roof tops that the system is facing a new threat of ‘liquidity crisis’ which should be avoided at any cost. RBI came with its instruments of monetary policy and made several attempts to pump liquidity (money supply) into the system by reducing CRR etc.

Now the question is whether this fall in liquidity due to the outward movement of hot money—is a liquidity crisis or just a ‘hot money crisis’ alone? Why did the RBI again intervened in the market to pump money into the system when the so called so efficient market mechanism is in overdrive? The very same pro-market fundamentalists pontificated that there should not be any sort of intervention the market as market, when let free, by itself will find out the most ideal solution and outcome! These incidents clearly unmasked the real agenda of market fundamentalists. They do want to follow the rules of free market and not ready to accept its outcomes. They but pontificate the virtues of market only to avoid all sorts of government intervention in the economy (Santhosh, 2008) . When the private players and their self-interest face a crisis they conveniently shed the market philosophy and implement all sorts of intervention only to save corporate self-interest for ever high profits.

Precisely because of this reason it is widely publicised that the economy is facing a liquidity crisis and the economy must be saved from its ominous consequences. The creation of an enabling environment for intervention for helping the private self-interest was the objective for this deliberate campaign. Why did not the market fundamentalists who crave for free market operation let the outflow of foreign exchange due to the fickle hot money component of capital market and the consequent fall in money supply (or liquidity) be corrected by the market itself. Recall, the very same people pontificated the benefits of free market operation repeatedly from all roof tops.

Factors that Influence Money Supply

Simple economic theory says that monetary authorities implement monetary policy by setting the interest rates and letting the money stock be determined by how much is demanded at that interest rate. But to complete the picture we need to understand the influences on demand for money. The three important factors that influence short term variations in nominal quantity of money demanded are nominal rate of interest, real GDP and the price level. The relation with the first is negative and the other two are positive. Real GDP and price level mainly depend upon production of goods and services in the economy. Movements in nominal rate of interest have bearing upon the movements in price level which is basically related to the production of goods and services in the economy. In short all the major factors that influence the nominal quantity of money demanded are basically related to the production of goods and services in the economy. As a matter of fact, the supply and demand for money have an important bearing upon the level of production in the economy.

“Hot Money Crisis” or “Hot Money Induced Liquidity Crisis”

But the above said events viz. the massive outflow of foreign exchange due to the fickle hot money component of the capital market and the consequent fall in money supply has nothing to do with the production in the economy. Hence, this fall in money supply is simply not a fall in liquidity or a liquidity crisis of the economy. Put other wise, this fall in liquidity is not a demand side phenomenon, ie., not due to a sudden rise in demand for money consequent to increased production of goods and services in the economy. As such, it is fall in money supply or liquidity due to the capricious element of hot money rather than any dramatic fall in the level of economic activity. Whatever be the phenomenon, it must convey the underlying features and characteristics of the phenomenon with its name. Hence the crisis under consideration must also convey its true colours that it must be referred as “hot money crisis” or at least “hot money induced liquidity crisis”.

But the market fundamentalists loathe this reference as it will eventually dig its on grave as general public will realise the manipulations done by the arms of government for fortifying the private self-interest of big corporates. Further more, it sends the clear message that these private players not all like the outcomes of market mechanisms even though they swear loudly every time about the multifarious advantages of free markets! They like market as long as it showers private benefits but at the moment when the market shows its true colours all these private players would take volte-face and beg for intervention by the arms of government as covertly as possible. Hence they popularise the general term of liquidity crisis for this “hot money crisis”.

Visit at: www.santhoshtv.in

Saturday, October 18, 2008

[Paper was later presented in “Confluence 2008”, Seminar Series conducted by Sree Narayana College, Alathur, Palakkadu affiliated to Calicut University, on 18th of November, 2008.]

1.1 Introduction

The much famed “Wall Street” simply became ‘Fall Street’ on an otherwise sunny day sending panic signals across the globe. The integration of markets of different countries, especially financial and capital, as a consequence of the so called resounding success 0f globalisation made its impact felt so swift across borders! This time it did not let the ‘mature economies’ go scot free who often proudly pontificate the virtues of ‘transparency’ and the benefits of religiously adhering to the capital adequacy norms of Bassle Settlements to the hapless chaps who struggle in the southern part of the equator . At last, globalisation showed its true colours and once again unfettered capitalism proclaimed from the roof top that it is so brittle and so irrational.

1.2 Excess liquidity growth and the eventual fall down

It is better to understand the chain of events that may happen when the central bank injects liquidity (or increases money supply) into the system. Increased liquidity means increased purchasing power and what usually follows is that, it moves to those areas where it can take more returns. Borrowing becomes the rule as rate of interest falls and the funds thus taken, will be parked at lucrative avenues. Naturally, financial assets like shares, securities etc and real estate becomes the preferred avenues for investment. Their prices then start to climb and a boom like situation sets in the economy. The upward movement of the economy gradually raise the concerns of inflation as prices are moving up. As inflation rises, the real rate of interest beings to fall (real rate of interest = nominal rate – inflation). To counter act, central bank intervenes in the market and take measures to raise the rate of interest to put the inflation under the leash. When interest rates rise, the prices of assets like shares and real estate becomes over valued and a switch back will happen from shares, real estate, etc to bank deposits and related form of assets. As such, prices of shares or real estate begin to fall and eventually the economy crash-lands and crisis unfolds the pall of gloom.

1.2.1 Three instances of Excess Liquidity in 20th Century

The three notable instances with excess liquidity growth in USA happened in 1928, 1987 and 1999. The last one was the result of dotcom and tech bubble during which the liquidity growth was at an annualized rate of 76% in the last quarter of 1999. At that time the Fed was preparing to deal with the ‘Y2K situation’ and wanted to make sure there was enough liquidity in the system. As a consequence, stock prices took a steep upward movement and the Nasdaq Composite stock index rose 107% in less than 6 months only to decline by -50% later.

1.2.2 Aftermath of dotcom bubble and 9/11, 2001

The investment in US fell remarkably in the wake of shattered business confidence after the dotcom bubble and lingering uncertainty consequent of the terror attack of 9/11, 2001. The US Fed adopted the easy money policy to restore confidence and to prop up rate of investment. Rate of interest started to fall and stayed below 2% level through out 2002-2005. Since September 11, 2001, a new mantra of ‘borrow and spend’ was coined where “consumerism has been cast as new patriotism”. The cheap money policy of the US Fed at last helped the economy to take a U-turn and a new growth trajectory was made visible by 2002. 1.2.3 Sub-Prime lending It was proclaimed as loudly as possible that the new growth trajectory, after the dotcom bubble, was the telling outcome of the resilience of the capitalist system which is so efficient, innovative and powerful to lay out new paths when the human ingenuity is let free to take course. As pointed out above, the continuous injection of liquidity into the system helped the rate of interest to fall considerably and to stay below 2% up to the end of 2005. Borrowing became easy and an effortless thing and the funds were recklessly spent on conspicuous consumption and investment in stocks and real estate assets. Spending on new residential houses became the preferred item. As demand for housing increased real estate prices also took an upward movement.

This booming price of housing and real estate assets gave a golden opportunity to the ‘innovative scamsters’ and speculators of the so-called ingenious financial markets. For private lenders, credit worthiness is one among the important criteria for giving loans. Credit worthiness is quantified through computing credit scores. Credit scores help to know about the payment history of the borrower. The score quantifies the credit history in terms of his ability and willingness to repay the loan taken by the borrower. This is done often by assigning a numerical value. A credit score greater than 660 makes him a prime borrower. Borrower with a score less than this is called as a sub-prime borrower and will not normally get loans because it is risky to lend. Their credit worthiness is considered as poor. But they also get loans if the additional risk is covered through higher rate of interest. Lending in this manner is called as sub-prime lending. Sub-prime lending involves sub-prime mortgages, sub-prime credit cards etc.

The main risk in the normal bank lending process is called as the ‘credit risk’ or the risk of default. Since the sub-prime lenders have high risk regarding default, they are offered loans with higher rate of interest than that of given to prime customers. Since the Fed rate is well below 2% level, even a higher rate of interest appears lower to such sub-prime customers.

1.3 The role of ‘Innovative’ derivatives

To reap the full benefit out of the boom situation, the financial institutions want to increase business as far as possible through whatever means possible. The original lenders who directly lend to the house owners for making the real estate purchases have a resource limitation in extending the business after a point. In this context, the financial derivative[1] ‘Mortgage Backed Securities’ (MBS) comes into the scene.

MBS is an asset backed security (ABS). Assets can be anything that has cash flows like mortgage loans, home equity loans[2], credit card payments, auto loans, etc. When the underlying assets are home mortgages it becomes MBS.

MBS is a repackaged loan. After the purchase of housing loans from banks and other non-banks which originally gave the loans , the financial institutions repackage them by pooling several loans into one. In other words, the housing mortgages are bundled together to form a single asset. By taking the original housing mortgage as the core asset they issue the financial security called as MBS. The MBS gets value only because it is backed by a real asset. Thus the value of the MBS depends upon the value of the basic/core variable or asset.

Then MBSs will be sold in the secondary capital market. This issue of new security (MBS) out of the original mortgage loan is called as the ‘Securitisation’ of residential mortgages[3]. The proceeds they earn from the sale of MBS will then be used to purchase new set of original mortgage loans from the primary lenders. In that process primary lenders are provided with liquidity enabling them to give fresh housing loans.

1.3.1 The Business Operation

As pointed out above, the original providers of housing loans are banks and non-bank mortgage institutions. Their capacity to make loans is limited by the availability of their resources. But the US government wanted to raise that limitation and liquidity in mortgage financing. Thus Fannie Mae[4] and Freddie Mac come into the picture. Up to 1968 only Fannie Mae was there and it purchased and held these housing loans with it from the originators of the loan. Fannie Mae raised resources from market by issuing debt in the form of securities. The interest rate on the securities issued by Fannie Mae was lower than the rate of interest charged for housing loans. Thus the spread between the rates is the income of Fannie Mae. Once Fannie Mae purchases loans from originators, they will get fresh resources which could be in turn used for giving new housing loans. Only that loans which are following the guidelines of Fannie Mae alone were purchased. Such loans are called as conforming loans. By and large this was the system up to 1970. Since these loans are conforming to the guidelines of Fannie Mae they were safe for the purchase and so posed no threat.

After 1970 with the creation of Freddie Mac, the new instrument MBS (Mortgage Backed Securities) were issued first in 1971. Fannie Mae also followed suit by 1981. Earlier they were only purchasing the loans by issuing debt. Now they were responding to the ‘innovations’ of financial market by issuing MBS.

MBS securities were purchased by the ‘Investment Banks’ in the Wall Street or else where. A guarantee will be given that the principal and the interest payments are given to the investment banks irrespective of any default by the original borrower. The institutions which issue MBS also benefits by collecting guarantee fee, service charge etc from the investment banks. It will also receive an interest rate spread. For example, if the rate of interest of the original loan is 6.5%, MBS institutions can take up to 2.5% as their various charges and only the remaining 4% rate of interest paid by the original borrower will be handed over to the investment banks. Thus it was a win-win situation for all players according to market enthusiasts. Even a 4% interest payment was a bonanza for the investment banks who were sitting on huge cash balances received from super rich persons. As long as these original mortgage loans were given to prime borrowers there is no apparent threat. Further more, MBSs were issued by government sponsored enterprises like Fannie Mae and Freddie Mac and there is only minimal risk. This was the situation up to 1995 or so.

But the landscape changed dramatically during the 1990s. It all started innocuously as private financial institutions sensed an opportunity in extending loans to self-employed individuals. The nature of their employment and the variable behaviour of their income and the consequent problems in furnishing documentary proof thereof initially motivated them to relax the requirements for becoming eligible for loan. Self certification of income, employment nature etc were became the only requirements. The additional risk in granting such loans is compensated by charging higher rate of interest. Later, loans are issued with still reduced documentation or with no documentation! The additional risk in such lending is covered by adopting the ‘risk-based pricing’ policy, that is, by charging higher rate of interest. (Such loan offering is prevalent in India also especially in the two wheeler loan market by following suit but surfaced only 2003 or so.) Gradually this way of dispensing loans were aggressively attempted by private entities to borrowers who have low credit scores. The additional risk is compensated by charging higher rate of interest.

But with high interest rates there will be only few takers for the loans. The borrower is attracted by offering low initial interest rates which will gradually but progressively increase after a small period. Such loans are called as adjustable-rate mortgages (ARM) where the rates for the initial 2 years were fixed and after that rates become flexible and is calculated by indexing them with LIBOR (London inter bank offered rate) plus a margin. During the initial period teasing interest rates (ranging from 0—2% interest) are offered. Both the borrower and the lender forget about the difficulty in repayment of such high interest loans by persons having poor credit worthiness. They simply gamble on the increasing real estate prices and put their hopes on it. The lender promises that a refinance option will be given at favourable terms and rates as and when there happens sufficient increase in residential prices. Everything appears fine as long as the real estate prices are booming.

1.4 The Complicated Phase of Sub-Prime Lending

Lending to self-employed with relaxed documentation requirements is understandable given the nature of their employment and income behaviour. But as time elapsed funds are loaned even as both the lender and the borrower knew each other that false statements are furnished in the self attestations. No body cared it and increasingly indulged in activity called as sub-prime lending. Even government sponsored agencies like Freddie Mac started to issue MBS with sub-prime mortgages as early as 1995.

The sub-prime lending and the MBSs of agency issuers like Fannie Mae and Freddie Mac were backed by their guarantee against any default. But this is not the case with non-agency MBSs (issued by private banks, investment banks, insurance companies, pension funds etc). No guarantee is there for the sub-prime element under such MBSs. The added credit and default risk were not covered. Even in the case of agency MBSs, the added risk created problems.

As a consequence, financial derivative called as CDO (Collateral Debt Obligations) surfaced in the sphere. Another credit derivative CDS (Credit Default Swap) also came into the scene as a cover of insurance in the event of any default.

1.4.1 Collateral Debt Obligations (CDO)

CDO is a special purpose vehicle. Assets form the core of a CDO. Assets of a CDO can be anything ranging from mortgage backed securities, corporate loans, bonds etc. The structure and assets of a CDO can vary on the basis of the structure and assets it holds. But the essential mechanism of all CDOs is same. CDOs offer access to various financial instruments issued by different entities through a single instrument. Hence the purchaser of CDO can have a diversified portfolio of assets and is believed to have helped him to diversify the risk.

Since CDO has a divergent portfolio, the risk associated with it also has a hybrid nature. Apart from that, the cash flow for the underlying assets is also not uniform and may have different repayment periods etc. When assets of a CDO are segregated on the basis of nature and degree of risk, and returns different layers or tranches are created. Some assets like MBS with prime borrowers have low risk while MBS with sub-prime borrowers have high risk. When they are segregated, the CDO is said to have two tranches[5]. Generally CDOs have three tranches called as Senior (lowest risk an AAA rated), mezzanine (medium risk) and equity (high risk and unrated). Investment banks purchase tranches according to their appetite for risk and this segregation of assets on the basis of risk is supposed to have helped to price securities in a more efficient manner.

CDO became essential as sub-prime lending was aggressively attempted in massive volumes which made it more and more risky as more and more poorly credit rated individuals were given loans . CDO deals with such increased level of risk. Already sub-prime MBSs are very risky. As new and new individuals with still poor credit scores are made eligible for loans it became very risky to buy such MBSs. The introduction of CDO thus enhanced and ensured continuous market for MBSs. The different layers or tranches are so created that it will be credit rated impressively by ‘independent credit rating’ firms. But it is now revealed that these very ‘independent’ credit rating firms colluded with the issuers that it advised how to design a CDO layer and to earn triple ‘A’ rating!

Apart from that, initially CDO were sold with ‘Credit Enhancements’. Its purpose is to reduce the risk associated with CDO. It reduces the risk by adding other assets (or collaterals like property, inventories, oil reserves, etc), third party loan guarantees, credit insurances etc with the CDO. All this give an assurance to the purchaser of CDO that it will be compensated if the original borrower defaults in any event. But as time elapsed, the level of credit enhancements were reduced and even not resorted at all.

CDS (Credit Default Swap) is another instrument which gives insurance to a bad or doubtful debts or CDOs. The investment bank which bought sub-prime CDOs was concerned about the associated risks. They purchase CDS from insurance firms or other financial institutions. In the event of a credit default the seller will make the payment and in that way CDS provided insurance cover for sub-prime doubtful CDOs. Insurance firms which sell CDSs, in turn, charge a protection fee similar to insurance premium. Thus the institutions thought that the risks involved with CDOs are effectively insured and neutralised! The ‘super efficient’ financial institutions took complete solace (with CDOs and CDSs) in the process of sub-prime fuelled economic boom[6]. Apart from normal CDOs , CDO squared and CDO cubed also surfaced. The CDO squared is created in the same manner in which CDOs are created but the underlying assets is CDO itself and the asset base of the CDO cubed is nothing but CDO squared!

In manner explained above, the ‘innovative’ financial institutions created lot of derivatives again upon the CDOs and sold them to all sorts of financial institution across global capital markets including investment banks, hedge funds, pension funds, banks, non banking financial institutions, insurance companies etc who were replete with resources collected from super rich individuals, pension and insurance contributions of ordinary citizens. The pricing of such additional financial derivatives were computed by using sophisticated computer models regarding the behaviour of the original borrower and the various possibilities like prepayment, curtailing, foreclosure, part payment etc with ever revising assumptions regarding the behaviour! Any way, the level of sophistication in the computer modelling notwithstanding, once a crisis happens at one spot, it spills over and all institutions, which indulged in this crazy and greedy rush for registering profits, across the globe, would fall like nine pins.

1.5 The Onset of the Crisis and the Downfall

When the interest rates started to move northwards by 2006-07, it became very difficult to repay the sub-prime loans. Moreover the adjustable-rate mortgages (ARM) entered into the phase of flexible rate regime when interest rates increased. The borrowers felt it difficult to make the repayment in these situations. The result was increased default rates and foreclosure rates. By that time housing prices also started to fall consequent of the fall in the demand for housing with the rise in rate of interest. When financial institutions attempted to sell the defaulted mortgages to recoup their money, they found that their value has been fallen well below the amount of debt on it! Crisis loomed everywhere and the rest of the story of collapse became history.

1.6 The lessons from the whole episode

Private lenders normally do not extend credit to customers having poor creditworthiness. Credit worthiness includes the repayment capacity, payment history, defaults committed for previous loans etc by the loanee. But these private financial institutions want to show a bloated balance sheet with bulging profits continuously and this greed prompted them to somehow give loans to even customers having poor credentials. A boom like situation in real estate sector gave them a golden opportunity. Even if a default happens, the value of the underlying asset (the house upon which loan is given) is high enough to pay the principal and interest as far as the real estate prices are soaring. They could sell the mortgage through ‘foreclosure’ and recoup what ever amount involved it in the form of principal, interest payments, other related charges etc. So these hell-bent lenders of all sorts, made all these lending bonanza and wrote all sorts of financial derivates upon them, with the clear understanding about the risks involved. They were very sure that they could sell all the mortgages in a soaring real estate market for hefty profits in any event of default.

The other financial institutions who are not directly involved in the sub-prime fuelled boom process like European and Asian banks and financial institutions (including the UK arm of ICICI bank and State Bank of India etc) purchased different kinds of derivatives created from the original housing loan given in US with a view to registering quick and easy profits.

All this clearly underscores the simple fact that in an era glorified phase of globalisation and unfettered capitalism all players wanted to show ‘growth’ figures in the monthly/quarterly/annual reports. Growth was so glorified, irrespective of the area in which it happens, and an artificial aura has been deliberately painted around it. The more substantive ‘growth process’ was relegated to the back place in the run-up towards the present crisis.

It is argued that the securitisation process and with the use of the so-called innovative derivatives, the risk associated with debts were successfully diffused. Robert Kuttner, who was once Business Week columnist, however, pointed out that securitisation of mortgages resulted in the concentration of risk rather than diffusing it, as every one is placing hopes on the soaring prices of residential plots. And exactly this was what happened.

1.6.1 Growth Concerns and Independent Policy making

It is now officially announced that Germany and Japan have entered into a phase of recession. The growth predictions of RBI have also taken a tail spin. In a glorified era of globalisation where the integration of global financial markets plays a vital role no country can keep away from a crisis that happens in few markets. Indian financial institutions had only a low exposure to sub-prime crisis as majority are public sector enterprises. But the largest private financial institution, ICICI bank, has indeed exposure to this crisis but it is the domestic regulatory environment prevented such institutions to indulge neck deep in to shady financial transactions like this. It is worth noting the fact that it is not because of any prudence or transparency in the dealings of the management of private institutions that averted a full fledged crisis in India but the strong regulatory environment and the irresistible resistance from the public that really saved the economy form the hell-bent reformers of Indian establishment.

But the opening up of capital market and the consequent inflow of funds from Foreign Institutional Investors (FII) that simply bloated the foreign exchange reserves of RBI is creating great problems to the economy. FIIs are taken back their investments by selling the shares and this was the reason for the heavy outflow of dollar in the past few weeks. The consequent fall in liquidity, as rupee is handed over to RBI for dollar by FIIs, is creating problems to the economy. It is to deal with this liquidity crunch RBI announced a slew of measures including reduction in CRR, repo rates, increased rate of interest for NRI deposits etc. SEBI has given permission to issue Participatory Notes (P-notes or PN) by FII to check the outflow of foreign exchange.

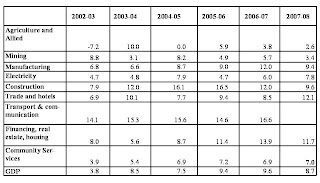

Rupee depreciated from around 39 to 49 between the period of January to October 2008 vis-à-vis US dollar. The SENSEX also took a dovetail from around 20,000 to around 10,000 during the same period. RBI intervened in the market heavily otherwise the exchange rate would have plummeted something near to Rs 60 per dollar! But even the Rs 10 depreciation could not help to boot exports in a situation of global recession. Export sector is already crippled with the crisis. The following table gives the sectoral growth rates of Indian economy. The share of agriculture is near to 20% while the service sector accounts more than 50% and the industrial sector accounts more than 25% of the GDP. Rate of growth of GDP at factor cost at 1999-2000 prices (per cent)

Rate of growth of GDP at factor cost at 1999-2000 prices (per cent)

Note: Plan period is simple average.Source: Economic Survey, 2008

The growth rate of service sector will be more affected consequent of this crisis. Since the sector’s share in GDP is higher its impact will also be greater on the overall growth of the economy. The Indian case becomes a lucid example as to explain how speculation in an open capital market led by FIIs creates havoc in the entire economy.

Independent policy making that takes into account the domestic realities and development objectives were the causalities during the heyday of neo-liberal economic policies shamelessly implemented by the market messiahs from 1991 onwards. One specific incident is pointed out to underscore the argument. The enactment of ‘The Fiscal Responsibility and Budget Management (FRBM) Act 2003’ that came into effect on July 5 2004 was taken by following the footsteps of neo-liberal paradigm and the policy initiates taken by nations like US. The eventual objective of the FRBM Act is highly susceptible given the words of the all-influential Milton Friedman, the champion economist of free market economy who clearly articulated that “A balanced budget amendment . . . is a means to an end. The end is holding down the growth of (or better sharply reducing) government spending” (Wall Street Journal, 4 January 1995, p. 12).

It is the Eleventh Finance Commission that set the ball to roll. It recommended the contents of the monitorable fiscal reform programme and the role envisaged for the next finance commission in reviewing the monitoring and implementation of the grants given under Article 275 of the Constitution. Prof. Amaresh Bagchi, member of the Eleventh Finance Commission, has given a note of dissent that the commission is not competent to make grants given under Article 275 of the Constitution conditional on implementation of a monitorable programme. But his views were brushed aside by taking shelter in the normative concept of sound finance in the Article 280 (3d) of the Constitution . It is through this backdoor the centre government forced the state governments to enact FRBM acts with a clear view to cut down public expenditure.

In addition, it must be noted that the decision to allow a small part of pension to be deposited in capital market is a grand strategy to make valid arguments beforehand when again in future the government need to save the capital market from similar crises.

Now the same perpetrators of this neo-liberal policy is advocating for a fiscal stimulus to the economy! The Economic Times, enthusiastic supporter of market reforms wrote an editorial titled ‘Fiscal stimulus needed’ on 17th of November, 2008! ‘The Teleraph’ published from Kolkatta, which has no left leanings, wrote on 14th of November, 2008 that Manmohan Singh was burdened with the contradiction of rejecting the left arguments for government interventions but to advice the same to global leaders to move out from this crisis!

What is relevant in the present context is how the government is preparing to design the fiscal stimulus for the economy. India has its own peculiarities and development objectives that need to be taken into account. More important is the fact that ‘fiscal stimulus’ is not a policy tool that has potency only in a phase of economic cycle. This aspect should be taken in to account before designing the details of the rescue plan.

1.7 Recapitulation

The present crisis demolished all the arguments that were repeatedly proclaimed from the roof-tops that ‘the government that governs least is the government that governs best’. All such arguments are laid to rest with this crisis. Media is abound with reports that the finance minister is busy advising public sector banks to lower interest rates contrary to the market philosophy stance that ‘market will correct by itself’. If are markets are let to correct itself there will be not only recession but would happen an all-round crisis as well. This is the most important lesson to be learnt from this crisis.

The crisis revealed that the so called ‘innovations of the financial market’ are nothing but machinations to amass profit at cost of public. It must be discerned that this greed for profit cannot be curtailed down by simply constituting regulatory mechanisms and other controls. It must be realised that capitalist system will devise ingenious methods to bypass whatever regulations imposed upon them in their quest to amass profits. The capitalist system could not function with out ever increasing profits lest it would not become capitalist system. The rescue plan must contain elements that reflect this inherent nature of forces of capitalism that drives the capitalist economy.

Visit at: www.santhoshtv.in

Endnotes

[1] Derivatives are financial instruments whose value depends upon the values of the underlying basic variables or assets. Options, futures are the popular examples of derivatives.

[2] Home equity loan is a loan given to an existing home loan borrower by considering the market value of the property for purposes like home improvement etc.

[3] Securitisation is a process whereby a financial asset is transferred into a security by pooling and repackaging the financial assets having cash flows in the form of interest and principal payments.

[4] It is instructive to have a brief idea regarding the institutions that roam in the terrain of residential mortgage markets. Both GSEs (Government Sponsored Enterprises) and private players are operating in the field.

One of the re-construction efforts initiated by Franklin Roosevelt through the ‘New Deal’ after the Great Depression of 1929 was in the field of housing. The ‘Deal’ wanted to stimulate house construction and tried ways to provide adequate credit for it. It wanted to establish an active and efficient secondary mortgage market. Thus it formed the “Federal National Mortgage Association (FNMA). It is commonly referred by the market participants as ‘Fannie Mae’. It was originally created as a federal agency under the ‘National Housing Act’ of 1938. But in 1968, it was split by an amendment to the ‘National Housing Act’ and converted ‘Fannie Mae’ into a GSE (Government Sponsored Enterprise) but to be run as a private corporation with a view to removing its activity from the federal budget to deal with the federal budget deficits . As a result ‘Fannie Mae’ could not be a guarantor of government-issued mortgages, which it was prior to that. That responsibility was then given to a newly created entity popularly called as ‘Ginnie Mae’ or the “Government National Mortgage Association” (GNMA).

Later with the passage of The Emergency Home Finance Act of 1970 another mortgagee entity called as ‘Freddie Mac’ (Federal Home Loan Mortgage Corporation) was also created. Its objective was to create a national level secondary market for residential mortgages and to increase the level of competition in the mortgage market.

[5] Suppose the bundled portfolio has a yield of 12% but different assets have varying risk. The first tranche having prime MBS are offered with an 8% return and the second tranche having sub-prime MBS is offered with a 16% return because of the higher risk it bears. Note that the weighted average of yield is equal to the yield of the initial portfolio.

[6] It is the CDS that was the main reason for the collapse of the insurance giant AIG. CDS were of the tune of 45 trillion US dollars (1 trillion = 1000 billion) on mid of 2007 which is almost double the market capitalisation of US stock market which had a value of only 22-25 trillion US dollars!

Sunday, March 23, 2008

It is true to say that Barak Hussein Obama’s Philadelphia (as it is delivered at Philadelphia's National Constitution Centre) speech may be considered as a sequestered one among the speeches that reflect the social and economic reality of the present day world in general and US in particular. To some it is one among the greatest speeches ever delivered. It may be considered as a sequestered one because it clearly shows that the “predicament of politicians”—especially during the run-up to power when confronting the barrage of criticisms—is ‘exactly same’, which side of the equator you are notwithstanding.

In short, Obama is confronting multifaceted criticisms and even abuses from the campaign side of Hilary Clinton ever since he proved that he is a real challenger to the once-thought-the-solitary contender for the democratic candidature for the Presidential election. Mrs Clinton became so nervous that she used all the dirty tactics against him and tried to manipulate the general sentiment among public by simply but cannily spreading rumours that Obama is a Muslim. It is true that his Kenyan father is a Muslim but his mother is a white US Christian and he is also a Christian. To prove that Obama supporters even produced evidence that it was none other than Pastor Jeremiah Wright who inculcated Obama into the faith of Christianity etc. Mrs. Clinton failed miserably, then but not for all. She opened then the next obvious flood gate to Obama. Suddenly the Sunday sermons of Pastor Jeremiah Wright were made readily available with the media including youtube.

The noteworthy fact about all these sermons is that they all were delivered in the past period. But they were made available as if they are delivered very recently! The common thread of all these sermons (the main three charges against Pastor Wright) is the references to racial discrimination of America, severe criticisms against US foreign policy, the view of terrorist attack on US as a natural backlash of its own policies etc. The purport is obvious. Plainly speaking, they have nothing to do either with the Presidential elections or with Obama. But conclusions are swiftly drawn and they are invariably linked with the credentials of Obama to lead USA. Just because of the reason that Obama’s marriage was solemnised by Wright or his daughters were baptised by him or he was brought into the faith by Wright or Wright was in the support committee of Obama, one cannot blame Obama for whatever speeches made by Wright. It all again proved that human beings respond in the same manner, that is, they let ‘passion to rule over reason’. Other wise this new controversy would not have happened.

Now, given this situation, what Obama must do, as just like any other politician who face a do or die battle? On April 22nd Obama is facing the vote at Pennsylvania state primary. Naturally he chose the Philadelphia's National Constitution Center of Pennsylvania state to make a reply to this virulent and nasty vilification campaign against him. In such a situation what would be the natural response of any politician? The simple and straight response would be to take a distance from the alleged three charges against Wright. Obama also did the same thing, nothing else!! Thus came the Obama speech at Philadelphia.

Many commentators thought that Obama in his speech pushed aside the issues of racial discrimination and rose above the sectarian views and made a clarion call for the discussion of issues which touch the USA as a whole. But BBC news story clearly showed that this is only a fiction and they aptly titled one story covering the Philadelphia speech as “Obama says US cannot ignore race” on 19th Wednesday of March 2008. But it is true that Obama wanted to discuss that issues which touch USA as whole also.

Thus the predicament of politicians is same regardless of the nation where the election battle is fought. Since he is a half-black, to win the election he need to win the white votes in a decisive manner. But now he has been painted as a person who still nurtures the issue of racial discrimination. So he wanted to convey the message that he has sympathy to the issues and problems of Whites also. Hence he made a call to conduct a joint effort by blacks and whites to overcome the problems of US in general rather than problems of black or white alone. What else Obama could do in such a situation?

His political predicament is understandable, but the grounds cited by Obama for a joint effort for the larger interests of America were so flimsy that it is very visible that he trips frequently thought out that speech if one makes a closer scrutiny. Thus it gives the impression that the Philadelphia speech was a clever smokescreen meticulously crafted by Obama to ward off the vilification campaign supposedly piloted by Mrs Clinton.

Let us first see what the commentators have to say:

David R. Henderson, research fellow with the Hoover Institution and associate professor in Economics argued that there are three faults with the Obama speech. First, Obama argued that Wright’s speech was full of hatred. But Henderson argued that Wright’s speech has only anger and have no hatred. Obama instead argued that Wright’s sermons were full of hatred and hence need to be brushed aside and condemned. But if anger when expressed with explanation cannot contain hatred, says Henderson. If that is the case, Obama’s speech looses one of its grounds.

Secondly Obama distorted the speech of Wright just to make mileage and strike a chord with the conservative whites who denounces Palestinian cause and blindly supports Israel. Wright only said that "We (US) supported Zionism shamelessly while ignoring the Palestinians and branding anybody who spoke out against it as being anti-Semitic." But Henderson pointed out that, in his speech, Obama referred to Wright's view as: "...a view that sees the conflicts in the Middle East as rooted primarily in the actions of stalwart allies like Israel, instead of emanating from the perverse and hateful ideologies of radical Islam." Henderson said that, that may be what Wright believes – Obama would know better than I – but that's certainly not what Wright said in the passage which Obama cited.

Third, Obama asks us to get past the race issue and look at the other issues in the campaign. But Henderson said that, in doing so, he stired up resentment against people (ie. The business managers) who are just as innocent as the struggling black man and the struggling white man displaced by affirmative action. Obama states: "Just as black anger often proved counterproductive, so have these white resentments distracted attention from the real culprits of the middle class squeeze – a corporate culture rife with inside dealing, questionable accounting practices, and short-term greed. Henderson pointed out that this is only a standard Democratic riff about how nasty corporations have caused a middle class squeeze and there have been Enrons (the notorious US company for shady accounting practises), but is Obama seriously saying that these have been so widespread as to make the middle class worse off?

Charles Krauthammer the columnist of Washington Post with the title, “The Speech: A Brilliant Fraud” (Friday, March 21, 2008; Page A17) argued that Obama's purpose in the speech was to put Wright's outrages in context. Charles said that by context, Obama meant history. And by history, he meant the history of white racism. He underlined that even though Obama in the speech said that "We do not need to recite here the history of racial injustice in this country," but proceeded to do precisely that. Charles asked what lied at the end of— Obama’s recital of the long train of white racial assaults from slavery to employment discrimination and said that it was nothing else other than Jeremiah Wright itself!!

Charles at last asked a question to Obama that if Wright is a man of the past (as Obama played down Wright by saying that he is a man past), then why would you expose your children to his vitriolic divisiveness and why did you gave $22,500 just two years ago to a church run by a man of the past who infected the younger generation with precisely the racial attitudes and animus you say you have come unto us to transcend?

The essence of these comments is that Obama’s speech is only a smokescreen to avoid the white backlash in the upcoming primary votes. Read with this the polls findings that even though 90 % of the blacks support Obama his support base among whites is still low.

I want to write more as to the ‘smokescreen’ argument but I feel that I wrote too much. If any body writes back I will get a chance.

To conclude, indeed, Obama clearly accentuated the adverse impact of white atrocities upon the blacks and clearly underscored that this issue cannot be wished away. But at the same time, he wanted to show that he understand the problems and hardships of whites also, otherwise how he could remain as a Presidential aspirant! And ironically, Obama’s “hope” that he could give better results for the whole USA clearly stems from the teachings of Wright especially from the sermon of “Audacity to Hope”!!!

Visit at: www.santhoshtv.in

Friday, February 1, 2008

[Welcome Speech and Introduction to the theme of the National Seminar “Emerging Issues in the Business Environment and their Implications upon Development”

Two day UGC—Sponsored National Seminar jointly conducted by Post Graduate Departments of Commerce and Economics, Government College, Malappuram.

March 14 (Wednesday) and 15 (Thursday) of 2007.]

Venerable president of the meeting Dr. KK Mohamed, Principal, Govt. College, Malappuram, Mr. MC Bose, Chairman, South Malabar Gramin Bank, valued vice-president of PTA Mr. Abdul Rassaq master, beloved secretary of alumni association Adv. Kunjumuhammed Paravath, VP and HOD of Commerce Mr. PK Velayudhan, HOD of Economics Mr. YC Ibrahim, my senior colleagues from various faculties Mr P Moideen kutty representing science faculty, Mr. Sabari K Ayyappan representing Humanities faculty, Mr PP Narayanan representing Social science faculty, college union chairman, distinguished delegates, other participants, my colleagues and dear students,

This seminar is being conducted in a dismal situation where a number of people were butchered at the alter of the so-called great development initiative in the name of SEZs. Perhaps, we are in the making of a record of sorts; a record for slaughtering helpless and hapless people in the name of economic development. Are we shattering the cherished dream of economic development so passionately envisioned by the founders of this great republic?

In another plane, politicians, policy makers and even academicians are chanting the all-new mantra of ‘inclusive growth and development’. The approach paper of the 11th five year plan titled its fourth chapter as, ‘Strategic Initiatives for Inclusive Development’. But strictly speaking, the concept of ‘inclusive economic development’ is fraught with theoretical ambiguity. It gives the impression that it germinates from lack of theoretical lucidity, even though the concept of inclusive growth is plausible otherwise. Why should we talk about ‘inclusive economic development’ when the concept of economic development itself is inherently inclusive? Moreover, the concept has different connotations that it alludes that ‘exclusive development—in the sense that developmental activities excludes different sections of the society—is also possible. If economic development is not inclusive it cannot be considered as economic development any more rather it should be something else which is far away from the concept as understood in the literature.

It all seems that we need to discuss, re-discover and reinforce the meaning of economic development, as, so expatiated by stalwarts of economic science right from Antonio Serra of Naples, the first economic theorist according to Prof. Joseph Schumpeter to the Indian pride Amarthya Kumar Sen.

Sen redefines development as entitlements that build capabilities that help human beings to enjoy freedom for which they have reason to believe. In other words, development is to be redefined in terms of universalisation and the effective exercise of all human rights: political, civil and civic; economic, social and cultural; as well as collective rights to development and environment. If economic development is defined and understood in this manner why should we waste words in the form of ‘inclusive economic development’? Or is it a decoy to divert attention from the core and fundamental issues of economic development itself? The seminar realises that it is high time to introspect and ponder in this respect.

The ambiguity in the understanding of development and the futility in the zest and zeal for rhetorical terms, become pertinent in the present economic scenario. On the one side, we see the mad rush for Special Exploitation Zones. On the other side we witness sky-rocketing growth rates for the privileged class and the nose diving share of GDP for the majority, who wane and wilt in the agricultural sector. It all seems that we do not understand properly the very basic tenets of economic science.

It is an all simple question and nothing complex is there as in the case of space research here. How we can proclaim progress when we displace people from their own land and make them refugees in their own region, how we can broadcast from the roof top that we are marching towards full employment when small and marginal employment generation activities are in the threat of being decimated. It is an all simple question, but solution to these nagging problems can be visualised only if our vision is incisive enough and free from the influence of free market philosophy.

We always pontificate the efficiency and wisdom of market forces arising out of competition but our entrepreneurs and enterprises are so scared about real competition in their on respective fields. No body wants the virtues of market mechanism that arise from competition rather all wants only monopoly elements to be tightly reinforced in their own fields all in the name of virtues of market mechanism!!

Take a simple example from the media industry and I am not naming any one. Market leaders in different segments spend uncountable space and time for educating the virtues of market reforms. But they seldom allow competitive elements to be flourished in their own segments. They virtually preach the virtues of market mechanism but adopt and follow only monopoly practices!! Remember, virtues of market friendly reforms do not flow from monopoly market practices. It will flow only from a situation where assets and capabilities are accessible to all and any attempt to dominate the market space will always increase the monopoly power. This deep gap between rhetoric and practise is so glaring and the seminar wants to take note of that as it will badly defeat whatever progress we have achieved so far.

It is in this backdrop we organise this national seminar. We have got some eminent academicians who did good research work in the respective areas. The keynote speaker Dr. KJ Joseph, fellow of CDS, is a well known economist whose present interest hovers around the growth and development of Asian economies. Further, we have professor in marketing from IIM Kozhikode Dr. Anadakuttan Unnithan and Dr. Joseph Thomas to criss-cross the hot issue of corporate entry to the retailing scenario. For the second session that deals with the issue of SEZs, we have TG Jacob who did his doctoral research at JNU on the problem of agricultural land utilisation of Waynadu. For the last session of mergers, acquisition and competitiveness we have Dr. Beena PL who did her doctoral research in the same topic under CP Chandrasekhar of JNU. We have many other speakers as well who conduct research in the respective areas. All these scholars confirmed their presence in the seminar, though some slight changes would be there with respect to their arrival.

Coming to the inaugural session we have invited the chairman of South Malabar Grameen Bank. Unfortunately he could not turn up here for this session. Mr. Ramesh Kumar, Senior GM of the bank will inaugurate the seminar. I extend you hearty welcome to this academic congregation.

Principal Dr. KK Mohamed is always the source of strength behind all our activities. When the UGC sanctioned the grant for a joint conduct of the seminar by the depts. of commerce and economics, this much enthusiasm for conducting the seminar was not there, sicnce it initially seemed that it was highly difficult to identify a theme equally acceptable for both the depts. Activities were totally lethargic in the early stages. But his constant motivation and enquiry about the progress of the seminar preparations, that really increased the pace of our activities. With out that intervention we could not have pursued the organisation of the seminar to this stage. On behalf of all the delegates and participants and on behalf of the seminar secretariat I extend you sir whole hearted welcome to this seminar.

PTA is an important pillar upon which the activities of institutions like this take their foundation both in terms of money and support. And Abdul rassaq master is an affable person to whom we can share and discuss our concerns. I extend you sir cheerful welcome to this occasion.

Alumni association is one among the very active organisations that function in the college and they always ahead in planning and implementing innovative projects for the college. Secretary of the organisation Adv. Kunjumuhamed Paravath is with us and I extend you sincere welcome to this august occasion.

My senior colleagues including Vice principal and HOD of Commerce Mr P K Velayudhan, Mr. YC Ibrahim HOD of Economics dept, Mr P Moideen kutty representing science faculty, Mr. Sabari K Ayyappan representing Humanities faculty, Mr PP Narayanan representing Social science faculty, college union chairman all are with us for the successful conduct of the seminar. On behalf of the seminar secretariat I extend you all, hearty welcome to this academic discourse.

Last but not least, (Before concluding, as the coordinator of the seminar I want to welcome all) the delegates and the participants of the seminar who came up here to make this event a grand gala success. We have teachers, research scholars and PG students from different parts of the state registered for the seminar. With out you the seminar has no meaning at all. I extend you all red carpet welcome to this academic discourse.

It is often said in a jocular manner that seminar is a place where the confusion of the speaker gets multiplied by the number of participants! I hope we would get a different experience from here.

Now let me conclude my speech here.

Thanks, thanks to all.

Visit at: www.santhoshtv.in

A Region Deranged.

[Keynote paper presented in the Workshop on “Kuttanadu Studies” organised by St. Berchmans’ College, Changanacherry, Kerala, India, in participation with IVO, Tilburg University, The Netherlands ,on January 23-24, 2002]

The study analyses the developmental problems of Kuttanadu region of Kerala state, India. The region has geographical similarities with The Netherlands as both lie below sealevel. Kuttanadu region is often considered as the rice bowl of Kerala. But the region is facing a crisis in paddy cultivation. Several projects were implemented to support the agriculture in Kuttanadu, but all failed to deliver the promised results. It is in this backdrop the study surveys major development projects implemented in this region and the analyses the crisis in Kuttanadu afresh.

The study undeniably displays that there is no pari passu relationship between decrease in paddy cultivation in Kuttanadu and Kerala. The index of area under production to the state as a whole decreased from 100 to 45.9 during the period of 1956-57 to 1999-2000. The index of area under Mundakan and Punja also inscribed a downfall, nevertheless painted a better picture than that of the former. The index stood at 57.4 and 76.6 in 1999-2000 respectively.

But, the index of Virippu crop fared badly and took a tailspin to 31.2 in 1999-2000.Thus it is obvious that crisis in paddy to the state as a whole is chiefly due to the decrease witnessed in the case of Virippu crop. Moreover, Virippu accounted for more than 50% of the area during 1956-57 by declined to near 30% by around 2000. The Punja crop has nothing to do with it as its share almost doubled during the same period.

Furthermore, it found that the factors responsible for the nosedive in area under paddy in Kuttanadu is region specific rather than state specific and wherefore should be dealt accordingly.

It is now pretty obvious that the decrease in area for Punja crop is valid only to Alappuzha district. The area and index to non-Alappuzha districts almost plateaued during the reference period while in case of production they marched towards new heights. The inference is that the reasons for dip in area under paddy in Kuttanadu are quite different to that of the decrease to the state as a whole. Had it been not so, the area under Punja crop in non-Alappuzha district would have been not remained almost unchanged.

Visit at: www.santhoshtv.in

Contents of the Paper

1 Contours of Kuttanadu

1.1 Mythological Roots and Historical Facts

1.2 Different Conjectures and the Term Kuttanadu

1.3 Antiquity and Prominence of Kuttanadu

1.4 Geographical Boundaries and Definition of Kuttanad

1.5 Location

1.6 Formation of Kuttanadu Thaluk

1.7 Climate

1.8 Geology of Kuttanadu

1.9 Soils of Kuttanadu

1.10 Geographical Features of Kuttanadu

1.10.1 The Pamba River System

1.10.2 The Vembanadu Lake

2 Pigeonhole of Land in Kuttanadu

2.1 Taxology of Wetlands of Kuttanadu

2.1.1 Kayal Padsekharams

2.1.2 Padasekharam in Bund Areas

2.1.3 The Kari Lands

2.1.4 Karapadoms

2.1.5 Kolappala Lands

3 A Wee History of Paddy Cultivation: A Detour

3.1 The Cultivation Practices

4 Genesis of Land Reclamation: A Tangent

4.1 Types of Land Reclamation

4.1.1 Natural Reclamation

4.1.2 Passive Reclamations

4.1.3 Deliberate Reclamations

4.2 Prospect of Kayal Reclamation

4.3 Respite in Reclamation

4.4 Kuttanadu Incandescent: The Era of Progressive Reclamations

4.5 The Process of Kayal Reclamation

4.6 Gilt-Edged Vision and Grit –Edged Mission: Anecdotes of Kuttanadan Chaebols

4.7 Economic Features of Kayal Reclamation and Cultivation

4.8 Meier’s “Double Dualism” and Theoretical Underpinnings of Kayal Cultivation

4.9 The R-Block Reclamation or “The Holland Scheme"

5 Freaks Of Nature and the Extent of Damage

5.1 Floods

5.2 Salinity

5.3 Acidity

5.4 Pests and Diseases

5.5 Problem of Weeds

5.6 The Problem of Transportation

6 Attempts to Unlock the Grid Lock of Nature

6.1 The Backdrop

6.2 Kuttanadu Development Scheme (KDS)

6.3 First Stage of KDS

6.3.1 Thottappally Spill Way

6.3.2 Thanneermukkom Salt Water Barrage

6.3.3 A-C Road

6.4 Expected Benefits from the Schemes

6.5 A Broadside on the Benefits

7 From Permanent Bunds to Semi-Submersible Permanent Bunds

7.1 Nature of Temporary Bunds and the Idea of Permanent Bunds 7.2 The Idea of Semi-Submersible Bunds and the KLDC Project

7.2.1 The Necessity of Semi-Submersible Permanent Bunds

7.2.2 Objectives of the Project

7.2.3 The Cropping Season

7.2.4 The Assumption of Kuttanadu Development Project

7.2.5 The Project in a Nutshell

8 Kuttanadu Paddy Cultivation Development Project

9 Second Thoughts on Schemes Implemented In Kuttanadu

9.1 Density of Kuttanadu

9.2 Interface of High Density, Dearth of Cultivable Land and Nature’ Fury

9.3 Food Scarcity and Paddy Development Projects

9.4 Stabilising Agriculture of Kuttanadu: A Mission Unaccomplished